You made a new hire! Hooray! What comes next, however, can be the ultimate party pooper: new hire paperwork. This is especially true if you don’t know where to start or you don’t have a system in place to make that day one paperwork run like a well-oiled machine.

If you’re new to hiring and onboarding, or simply want to tighten up your knowledge, this how-to guide should leave you feeling confident that you have your bases covered so you can move forward with what’s most important: getting your new hire up to speed so they can start making an impact!

New hire forms:

- Form I-9

- W-4

- State new hire tax forms

- New hire reporting

- Offer letter

- Employment agreement

- Employee handbook acknowledgment

- Direct deposit authorization

- Emergency contact information

- Policy acknowledgements

- Benefits information

- New hire questionnaire

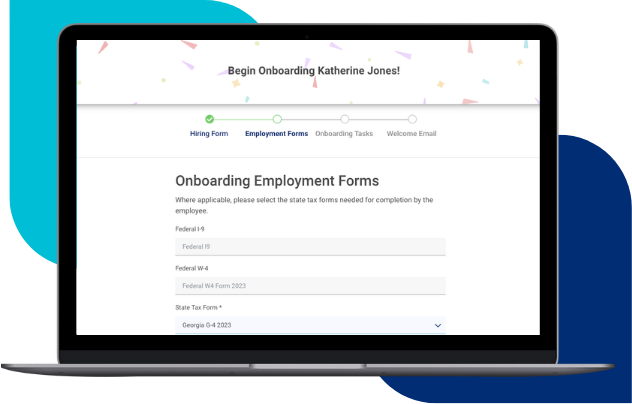

Ditch the piles of paperwork and filing cabinets with CareerPlug’s onboarding tools

Automatically send all new hires digital documents and tasks, automated reminders, and easily monitor their progress. Completed forms are stored securely online and can be accessed anytime in your employee’s profile.

LEARN MORENew hire forms checklist

New employee forms fall into two major categories: federal and state forms, which are required by law and standard new hire forms, which are specific to your company’s human resources operations. Combined, these forms make up our new hire employee forms checklist:

Federal and state forms

There are a few new hire forms that all U.S. employers need to have their employees fill out at the start of their onboarding process.

Form I-9

The Form I-9 verifies a new employee’s identity and their eligibility to work in the United States. It has an employee and employer section, with employees required to complete their portion by the first day of their employment.

Employers must physically examine identification documents the employee provides and complete the form no later than 3 days after the employee starts employment.

This form is the big one and it’s worth reading the instructions provided to ensure you’re staying compliant here as there are some pretty hefty penalties for both unintentional mistakes and willful noncompliance. For example, the minimum fine for a technical violation is $234 per individual.

Retention: You must keep the Form I-9 on file three years after the date of hire or one year after the date employment ends.

You can download the Form I-9 here and read the full instructions for Form I-9, employment eligibility verification here.

W-4

The W-4 tells you, the employer, how much to withhold from an employee’s pay for the correct federal income tax. Every employee should complete this when they are hired and must submit an updated W-4 if they ever want to change their withholding.

Retention: You must keep a Form W-4 on file for each employee for at least four years after the date the employment tax becomes due or is paid (whichever is later).

You can download the W-4 Form here.

State new hire tax forms

Many states have their own form for withholding state income tax. You should visit your state’s revenue site to learn about what forms are required in your state.

New hire reporting

You’ll need to let your state government know that you’ve made a new hire to stay compliant with the Personal Responsibility and Work Opportunity Reconciliation Act of 1996 (PRWORA).

One key provision of PRWORA requires certain new hire information be reported in order for state agencies to effectively enforce child support. Where to send this info, the time frame, and any additional reporting requirements vary by state.

Use this State New Hire Reporting Guide from the federal OCSE website. A Multistate Employer Registry is also available, which allows an employer to report all of its new hires in any state where it has employees.

Standard new hire forms

The following are forms that are not required by any governing bodies, but are important to successfully onboarding new employees to your company.

Offer letter

You should provide candidates with an offer letter outlining the terms of their employment. The offer letter typically includes:

- The type of employment (Ex: full-time/part-time or hourly/salaried)

- Compensation

- Company benefits

- Start Date

- Supplemental Material (ex: detailed benefits information or commission plan)

Retention: You must keep the offer letter on file for at least three years after termination.

Click here to download a sample offer letter template you can edit.

Employment agreement

An employment agreement outlines the rights and responsibilities of both you and the employee. It’s more detailed than an offer letter and will also include any special obligations unique to your hiring situation such as nondisclosure agreements or non-compete agreements.

While you can find free templates online, we suggest you consult with an employment attorney to create an agreement that is suited to your business.

Retention: You must keep the Employment Agreement on file for at least three years after termination.

Employee handbook acknowledgement

An employee handbook typically includes human resources and legal information, company policies, company benefits and perks, and other information core to your people operations.

You’ll want to provide this handbook to employees upfront and have them sign off that they’ve received and reviewed the handbook with an acknowledgment form.

Retention: You must keep all policy acknowledgments on file for at least three years after termination.

Download a sample employee handbook acknowledgment form here.

Direct deposit authorization

If you’re paying employees by direct deposit (as most employers do), you’ll need to gather your employees’ bank account information so you know where to send their paychecks.

Your payroll provider may provide you with a standard form, but if you’re creating your own, it should at a minimum include:

- Bank Name

- Type of Account (Checking or Savings)

- Routing Number

- Account Number

- Employee Name & Signature

- Date Signed

- Language to the effect of: “This authorization will be in effect until the Company receives a written termination notice from myself and has reasonable opportunity to act on it.”

You can also use a form that allows employees to split their deposit into multiple accounts or that requires a voided check on file for each account.

Retention: You must keep direct deposit records on file for at least four years after termination.

Emergency contact information

It’s a good idea to keep emergency contact information on file for all employees. This is a simple form with the contact name, phone, email, and relationship to the employee.

Click here to download our sample emergency contact form.

Policy acknowledgments

If you have any other policies not documented in your handbook, have new hires review and sign off on their first day. For example, if you have a separate policy about internet usage or sales commissions, include it with your new hire paperwork.

Retention: You must keep all policy acknowledgments on file for at least three years after termination.

Benefits information

Make it as easy as possible for your new hires to enroll in your benefits program. Provide them with plan summaries and enrollment instructions upfront as well as who to go to (if it’s not you) to answer their benefits questions.

Your insurance provider or benefits broker will provide you with the correct enrollment forms and many now use online portals so you don’t have to mess with lengthy paper documents.

Retention: Health and benefits forms should be kept on file for three years after termination.

New hire questionnaire

New employee forms are admittedly pretty dry, but onboarding shouldn’t be! We include a get-to-know-you questionnaire in our onboarding process so we can help break the ice while introducing them to the company.

Here’s what we ask at CareerPlug:

- Introduce yourself… elevator pitch style.

- Which of our core values stood out the most to you? Why?

- What are you passionate about?

- What’s your favorite hometown meal?

- If you could visit anywhere in the world you’ve never been, where would you go?

- The last great book I read was…

How CareerPlug makes onboarding easier

It’s helpful to have handy resources (like this) to double-check the forms you need after you make a hire. But having the right hiring and onboarding software can help ensure you never miss an important step again.

CareerPlug’s new onboarding tools can help you automate all of your new hire process. As soon as you mark a hire in the system, CareerPlug will automatically send them the required paperwork and tasks.

From there, you can monitor their progress, and easily keep things moving. This prevents any hold ups and can help you get your new hire onto more important tasks – like training for their new job!

Plus, this provides a better experience for new hires and leaves a lasting positive impression, which is crucial for retention. 69% of employees are more likely to stay with a company for at least 3 years after a great onboarding experience.

Onboarding beyond the paperwork

Remember when I said onboarding shouldn’t be as dry as all these compliance forms? It really shouldn’t!

As you envision your new hire’s first day, think beyond the paperwork when you create their experience:

- How will they understand your company culture?

- How will their coworkers get to know them?

- How will they feel welcome in your work environment?

- How will they know the expectations and milestones of their training?

The hiring experts here at CareerPlug have also created a free 90-day onboarding checklist you can download and use for your own onboarding needs.

Onboard new hires better with CareerPlug

Learn how CareerPlug can streamline all of your recruiting, hiring, and onboarding processes – saving you time, money, and hassle.

GET STARTED